If a previous mortgage deal has ended and you’ve not taken out a new one, you could be paying a much higher rate of interest. If you’re on your lender’s standard variable rate (SVR), read on to find out why a new mortgage deal can make sense.

When you take out a mortgage, the deal is for a fixed period, often two, three or five years. After this period, you’ll normally be moved on to your lender’s SVR. While this can provide more flexibility – you may wish to make overpayments, for example – the interest rate you’re paying is unlikely to be competitive.

As interest rates start to climb after more than a decade of being low, now could be the time to look for a new deal.

The average standard variable rate for June 2022 reached 4.91%

To tackle rising inflation, the Bank of England (BoE) has increased its base interest rate several times this year.

The inflation rate was 10.1% in the 12 months to July 2022, and the BoE expects it to reach 13%. It’s anticipated that the BoE will continue to make gradual increases to the base rate, but the Bank could make sharper rises to control inflation.

Changes to the base rate affect the cost of borrowing, including mortgages.

If your mortgage isn’t fixed-rate, you’ve likely already noticed that your repayments have started to increase. As SVRs are usually higher than other types of mortgage product, homeowners that haven’t searched for a new mortgage deal could find they’re paying much more in interest than they need to.

According to Moneyfacts, the average SVR in June 2022 reached 4.91%. This is the highest recorded since February 2009, which was just before the base rate fell below 1% following the financial crisis.

Rates can vary significantly between lenders, so you should check how much interest you’re paying and how it affects your outgoings.

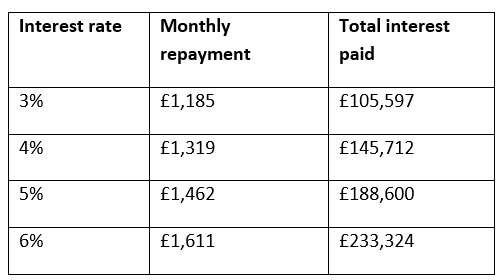

Even a small difference in the interest rate can save you money each month, and this adds up over the full term of your mortgage. The below table highlights how the interest rate affects finances for a £250,000 repayment mortgage with a term of 25 years.

Source: Money Saving Expert

So, if you’re paying your lender’s SVR, finding a new mortgage deal could save you money now and in the long term.

As interest rates climb, should you choose a fixed-rate mortgage?

If you’re on your lender’s SVR, the interest rate you pay is variable. This means it can rise and fall each month.

At a time when interest rates are slowly rising, choosing a fixed-rate mortgage can make sense for some people.

While the interest rate on a fixed-rate mortgage is likely to be initially higher than the alternatives, it will remain the same for a defined period, such as two years. This can make managing your budget easier.

Over the full term, it could also mean you save money when compared to other options, assuming the base interest rate continues to rise. However, you wouldn’t benefit if interest rates fall.

In contrast, the rate of a variable or tracker mortgage could change during the deal. The current economic situation means it’s likely that interest rates will continue to rise over the coming months, which would mean that your mortgage repayments would also rise. However, this cannot be guaranteed.

There’s no one-size-fits-all mortgage solution. If you’re looking for a new deal, weighing up the pros and cons of tracker-, variable-, and fixed-rate options is important.

Finding the right mortgage deal for you

It’s not just the interest rate that’s important when you’re searching for a new mortgage deal.

Things like the flexibility to overpay, whether upfront fees are required, and portability are all things you need to take into consideration. If your previous mortgage deal has ended, please contact us. We’ll help you find a mortgage that reflects your needs and priorities.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.